Choosing the right 1031 exchange company is crucial for real estate investors looking to defer capital gains taxes. After facilitating over 30,000 exchanges and working with investors from beginners to sophisticated family offices, we've identified the top traits that deliver exceptional results.

A single mistake in your 1031 exchange can cost hundreds of thousands—even millions—of dollars in deferred taxes. This comprehensive guide reveals the best 1031 exchange companies and what separates great qualified intermediaries from mediocre ones.

Table of Contents

- What Makes the Best 1031 Exchange Companies

- 1031 Exchange Company Costs and Fees

- The 1031 Exchange Process

- Red Flags to Avoid

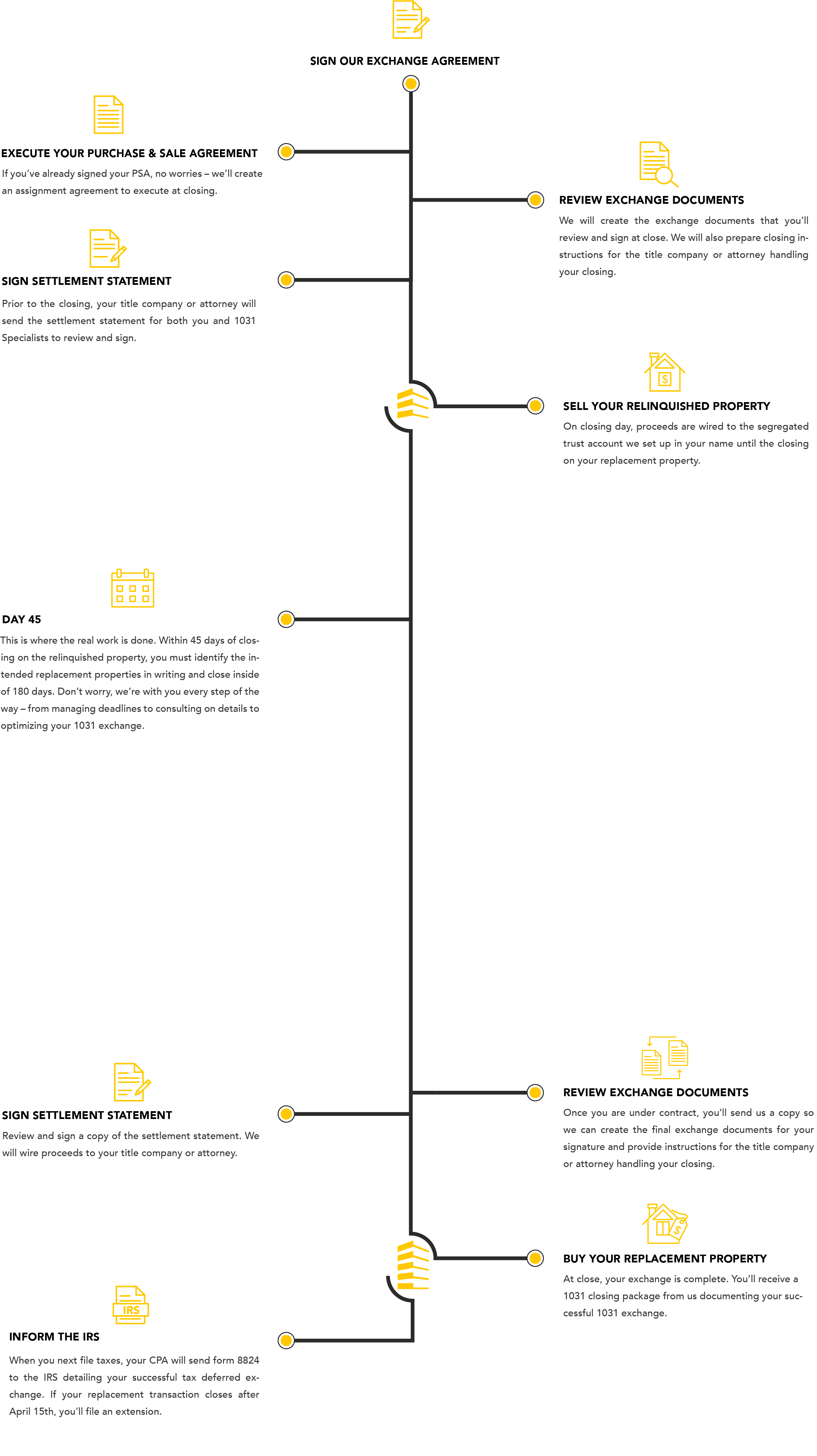

- 1031 Exchange Process Step-by-Step

- Frequently Asked Questions

What Makes the Best 1031 Exchange Companies?

1. Extensive Experience Across All Exchange Types

The best 1031 exchange companies have deep experience handling:

- Delayed exchanges (most common type)

- Reverse exchanges (purchase before sale)

- Improvement exchanges (construction on replacement property)

- Multi-property exchanges

- International property exchanges

This breadth of experience ensures they can navigate unexpected challenges and keep your transaction compliant with IRS regulations.

2. Comprehensive Insurance Coverage

Your Qualified Intermediary holds potentially millions of your dollars. Top companies provide:

- High-limit fidelity bonds ($1 million minimum)

- Errors and omissions insurance

- FDIC-insured segregated accounts

- Professional liability coverage

- State licensing and regulation

3. Transparent Pricing Structure

The best 1031 exchange companies offer clear, upfront pricing without hidden fees. Look for companies with money-back guarantees and simple, easy-to-understand fee schedules.

4. Educational Resources and Expert Support

1031 exchanges involve complex IRS rules and strict timelines. Top companies provide:

- Comprehensive educational resources

- Tax calculation tools

- Direct access to exchange specialists

- 24/7 customer support

- Regular client updates

1031 Exchange Company Costs and Hidden Fees to Watch Out For

Typical 1031 Exchange Costs

Standard Delayed Exchange:

- Range: $1,000 - $2,000

- Average: $1,500

- Includes: Basic exchange facilitation, document preparation, fund holding

Reverse Exchange:

- Range: $9,000 - $13,000

- Average: $11,000

- Includes: Exchange accommodation titleholder setup, enhanced services

Improvement Exchange:

- Range: $10,000 - $20,000

- Average: $15,000

- Includes: Construction management, development oversight

Hidden Fees to Watch For

- Wire transfer fees

- Document preparation charges

- Amendment fees

- Expedited processing costs

- Named beneficiary fees

We Do Things Differently

1031 Specialists Service Levels and Pricing

Standard Exchange: $1,195

- Unlimited tax optimization consulting

- Audit protection

- Attorney guarantee

- Money-back guarantee

**Our money-back guarantee means you get your money back if you decide not to proceed for any reason.

Reverse Exchange: $7,995

- Exchange accommodation titleholder creation

- All standard exchange features

- Complex transaction handling

Improvement Exchange: $9,995

- Development and improvement capabilities

- All reverse exchange features

- Construction management support

The 1031 Exchange Process

We handle complex logistics while you focus on finding the right properties.

1031 Exchange Process Step-by-Step

Phase 1: Pre-Exchange Planning (30-60 days before sale)

- Consult with your Qualified Intermediary

- Review property portfolio and goals

- Execute exchange agreement

- Prepare documentation

Phase 2: Sale of Relinquished Property (Day 0)

- Coordinate with closing attorney/title company

- Transfer proceeds to qualified intermediary

- Receive exchange documentation

- Begin 45-day identification period

Phase 3: Identification Period (Days 1-45)

- Identify potential replacement properties

- Submit written identification to QI

- Conduct due diligence on properties

- Negotiate purchase agreements

Phase 4: Exchange Period (Days 46-180)

- Complete financing arrangements

- Coordinate closing with QI

- Transfer funds from QI to closing

- Receive deed to replacement property

Phase 5: Post-Exchange (After Day 180)

- Receive final exchange documentation

- File tax returns with exchange documentation

- Maintain records for IRS compliance

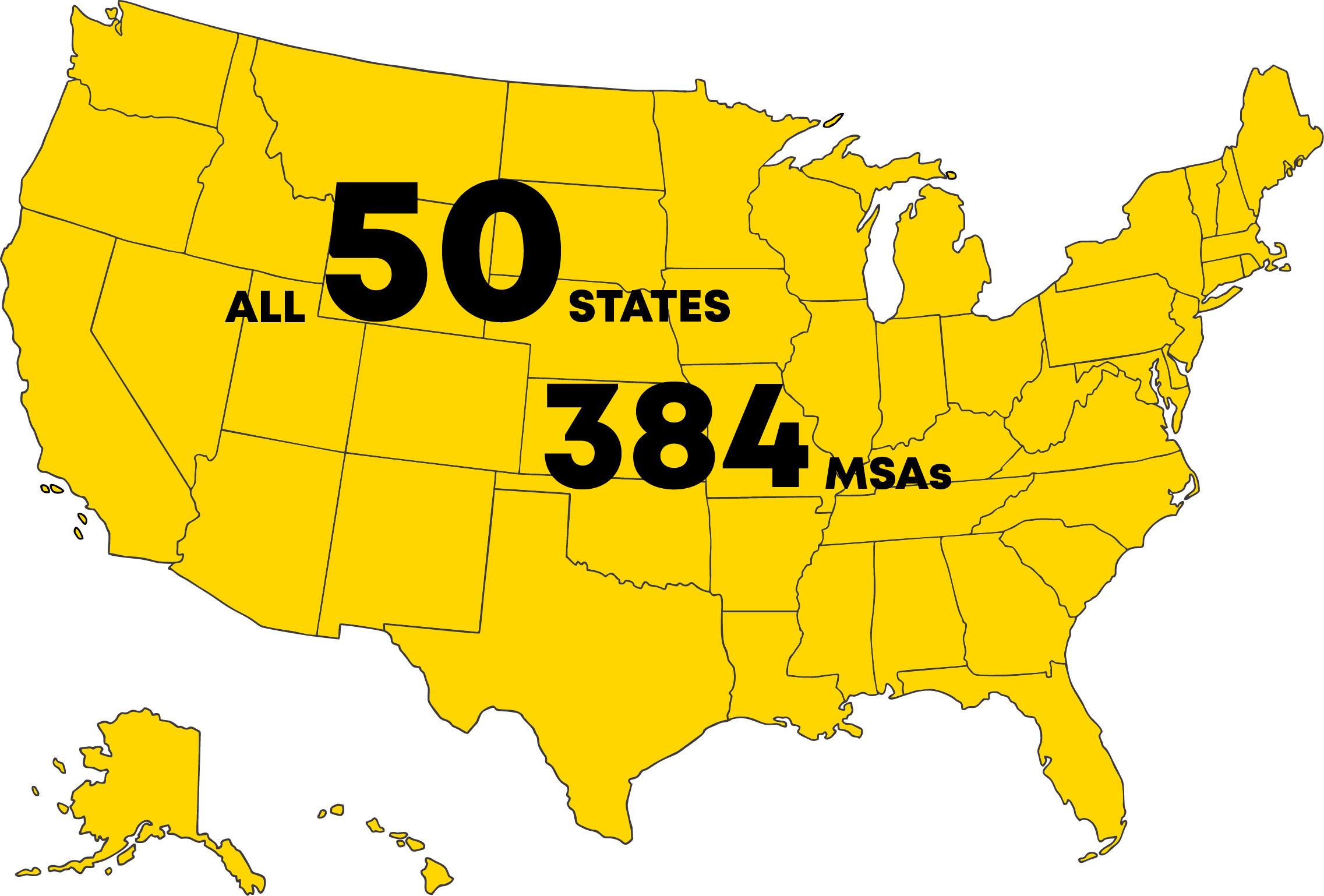

Nationwide Coverage

1031 Specialists operates in all 50 states across 384 metropolitan statistical areas:

How to Choose a 1031 Exchange Company

1. Experience with Your Transaction Type

Ensure your chosen company has specific experience with:

- Your type of exchange (delayed, reverse, improvement)

- Your property type (commercial, residential, industrial)

- Your transaction size and complexity

2. Financial Security and Insurance Requirements

Verify the company provides:

- FDIC-insured segregated accounts

- Minimum $1 million fidelity bond

- Errors and omissions insurance

- State licensing and regulation

- Professional liability coverage

3. Communication and Support Standards

Look for companies that offer:

- Quick response times (within 24 hours)

- Clear status updates throughout the process

- Extended or 24/7 support availability

- Knowledgeable staff who understand your situation

- Direct access to 1031 specialists

4. Technology and Convenience Features

Modern 1031 exchanges should include:

- Online application processes

- Digital document management

- Real-time transaction tracking

- Electronic fund transfers

- Mobile-friendly platforms

5. Educational Resources and Tools

The best companies provide:

- Comprehensive FAQ sections

- Educational webinars and videos

- Tax calculation tools

- Direct access to experts

Red Flags to Avoid When Choosing a 1031 Exchange Company

Warning Signs of Poor Service

- Vague or hidden fee structures

- Pressure to use affiliated services

- Poor communication or slow response times

- Lack of proper licensing or insurance

- No client references or track record

- Unwillingness to explain the process clearly

- Pooled client funds

Questions to Ask Potential Companies

- What is your total fee structure including all potential charges?

- What types of insurance coverage do you carry?

- Can you provide recent client references?

- What is your average response time for questions?

- Have you ever had a disqualified exchange?

- What happens if I need to cancel my exchange?

The True Cost of Choosing the Wrong 1031 Exchange Company

Common Costly Mistakes

Missing Critical Deadlines:

- Cost: Full capital gains tax liability

- Cause: Poor communication or inexperienced handling

Improper Documentation:

- Cost: Disqualified exchange, full tax liability

- Cause: Inadequate legal expertise

Inadequate Insurance:

- Cost: Lost funds, no recourse

- Cause: Insufficient coverage or uninsured intermediary

Hidden Fees:

- Cost: Reduced returns, unexpected expenses

- Cause: Lack of transparency in pricing

Real-World Example

A investor selling a $2 million property with $800,000 in capital gains could face:

- Federal capital gains tax: $200,000 (25% depreciation recapture + 15% long-term gains)

- State capital gains tax: $80,000 (varies by state)

- Total tax liability: $280,000

Choosing the wrong qualified intermediary and losing this deferral would cost $280,000 in immediate taxes.

Advanced 1031 Exchange Strategies

Multi-Property Exchanges

Exchange one property for multiple properties or vice versa:

- Benefits: Diversification, risk management

- Considerations: Complex identification requirements

- Best For: Portfolio optimization strategies

Delaware Statutory Trusts (DSTs)

Invest in fractional interests in institutional-grade properties:

- Benefits: Professional management, diversification

- Considerations: Limited control, fees

- Best For: Passive investors, estate planning

State-Specific 1031 Exchange Considerations

High-Tax States

California, New York, New Jersey:

- Higher state capital gains rates increase 1031 benefits

- More complex state regulations

- Greater scrutiny on exchanges

No-Tax States

Florida, Texas, Nevada:

- Focus on federal tax benefits and depreciation recapture tax

- Popular destination states for exchanges

International Considerations

Foreign Properties:

- Like-kind exchange rules apply

- Additional reporting requirements

- Currency exchange considerations

Technology and 1031 Exchanges

Digital Document Management

Modern QIs should provide:

- Secure online portals

- Digital signature capabilities

- Real-time document tracking

- Mobile accessibility

Automated Compliance Monitoring

Look for companies offering:

- Automated deadline tracking

- Compliance alerts and reminders

- On demand reporting

Building Long-Term Wealth with 1031 Exchanges

Portfolio Diversification Strategies

Use 1031 exchanges to:

- Geographic diversification: Spread risk across markets

- Property type diversification: Balance commercial, residential, industrial

- Cash flow optimization: Trade up to higher-income properties

- Risk management: Move from active to passive investments

Estate Planning Integration

1031 exchanges support estate planning through:

- Stepped-up basis at death eliminates deferred gains

- Wealth transfer to heirs without tax consequences

- Portfolio consolidation for easier management

- Liquidity planning for estate taxes

Retirement Planning Applications

Incorporate 1031 exchanges into retirement by:

- Building passive income through net lease properties

- Reducing management burden with professional management

- Creating legacy assets for future generations

- Optimizing cash flow for retirement needs

Why Choose 1031 Specialists

Our Track Record

- 30,000+ completed exchanges

- Zero disqualified transactions

- Nationwide coverage in all 50 states

- Expert team of 1031 specialists

Our Guarantee

We offer the industry's strongest guarantee:

- Pay when you close - get your money back if you don't proceed

- Attorney guarantee - legal protection for your exchange

- Audit protection - support if IRS questions your exchange

Our Process Advantage

Unlike other companies, we:

- Provide unlimited consulting throughout the process

- Offer transparent pricing with no hidden fees

- Maintain direct communication with decision-makers

- Deliver personalized service for every client

Getting Started with Your 1031 Exchange

Immediate Next Steps

- Assess your situation: Determine if a 1031 exchange makes sense

- Schedule consultations: Speak with 2-3 top companies

- Compare proposals: Review fees, services, and guarantees

- Make your decision: Choose based on experience, security, and service

Resources for Further Learning

- Chat with our AI assistant at 1031Specialists.com

- Take our free email course "1031 Tax Free Wealth" at 1031taxfreewealth.com

- Get a free personal consultation at (631) 438-1031

Frequently Asked Questions About 1031 Exchange Companies

What is a 1031 exchange and how does it work?

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows real estate investors to sell investment property and purchase replacement property while deferring capital gains taxes. The process requires using a qualified intermediary to hold the sale proceeds.

How much do 1031 exchange companies charge?

1031 exchange company fees vary by transaction type:

- Standard exchanges: $1,000 - $2,000

- Reverse exchanges: $9,000 - $13,000

- Improvement exchanges: $10,000 - $20,000

Always ask for complete fee schedules to avoid hidden charges.

What types of properties qualify for 1031 exchanges?

Most investment and business-use properties qualify, including:

- Rental properties (single-family, multi-family)

- Commercial buildings (office, retail, industrial)

- Raw land held for investment

- Vacation rentals (with proper documentation)

- Agricultural properties

Primary residences don't qualify.

What are the 1031 exchange deadlines I must meet?

The IRS imposes strict deadlines:

- 45 days: To identify potential replacement properties

- 180 days: To complete the purchase of replacement property

- Both deadlines: Run concurrently from the sale date

Missing either deadline disqualifies your exchange and triggers immediate tax liability.

Can I do a 1031 exchange across state lines?

Yes, 1031 exchanges can cross state boundaries. Properties in different states can be exchanged as long as they meet the like-kind requirement. Choose a qualified intermediary with nationwide experience and state-specific knowledge.

What happens if I don't complete my 1031 exchange?

If you fail to complete your exchange within the required timeframes, you'll owe capital gains taxes on the sale of your relinquished property. This includes:

- Federal capital gains tax (0%, 15%, or 20% depending on income)

- Depreciation recapture tax (25%)

- State capital gains tax (varies by state)

- Net investment income tax (3.8% for high earners)

Do I need to reinvest all proceeds from my property sale?

To defer all capital gains taxes, you must:

- Reinvest all net proceeds from the sale

- Purchase property of equal or greater value

- Replace all debt or add additional equity

Any cash you receive (called "boot") will be taxable at capital gains rates.

How many 1031 exchanges can I do?

There's no limit to the number of 1031 exchanges you can complete. Many successful investors use them repeatedly to:

- Build wealth over time

- Continuously defer taxes

- Upgrade their property portfolios

- Adapt to changing market conditions

Can I use a 1031 exchange for property improvements?

Yes, through an improvement exchange (also called a construction exchange). This allows you to:

- Purchase land and construct improvements

- Buy property and make substantial renovations

- Add value while deferring taxes

Improvement exchanges are complex and typically cost $10,000-$20,000 due to additional legal and administrative requirements.

What insurance should my 1031 exchange company have?

Your qualified intermediary should carry:

- Fidelity bond: Minimum $1 million coverage

- Errors and omissions insurance: Professional liability coverage

- FDIC insurance: For segregated exchange accounts

- State licensing: Where required by law

Always verify coverage amounts and request certificates of insurance.

Can I change my mind after starting a 1031 exchange?

Most reputable 1031 exchange companies offer some form of cancellation policy. Look for:

- Money-back guarantees

- Refund policies for unused services

- Clear cancellation procedures

- Minimal or no cancellation fees

At 1031 Specialists, we offer a full money-back guarantee if you decide not to proceed.

How do I know if a 1031 exchange company is legitimate?

Verify legitimacy by checking:

- State licensing and regulatory compliance

- Insurance coverage and bond amounts

- Client references and testimonials

- Track record of completed exchanges

- Professional backgrounds of staff

Avoid companies that won't provide references or proof of insurance.

Conclusion: Choose Your 1031 Exchange Company Wisely

Selecting the right 1031 exchange company is one of the most important decisions in your real estate investment journey. The qualified intermediary you choose will handle potentially millions of dollars and must navigate complex IRS regulations to protect your tax deferral.

Remember, the cheapest option isn't always the best value. Focus on experience, security, service quality, and transparency. A few hundred dollars in additional fees is insignificant compared to the potential tax savings and wealth-building opportunities a 1031 exchange provides.

Whether you're completing your first exchange or your tenth, choosing a qualified intermediary with proven expertise, comprehensive insurance, and genuine commitment to your success is essential. Your financial future depends on making the right choice.

Ready to start your 1031 exchange? Contact our team at 1031 Specialists for a free consultation and discover how we can help you build tax-free wealth through strategic property exchanges.

.jpg)