Picture this: Your client just sold their investment property for a massive profit, but instead of celebrating, they're panicking about the tax bill. What if I told you there's a perfectly legal way to help them defer those taxes entirely while you earn additional commissions and create a lifelong investor relationship?

Welcome to the world of 1031 exchanges.

I've been in the trenches of real estate transactions long enough to know that most agents are leaving money on the table by not understanding 1031 exchanges. This isn't just another tax strategy – it's the closest thing to a cheat code for building wealth that exists in real estate.

What Exactly Is a 1031 Exchange?

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows real estate investors to swap one investment property for another while deferring capital gains taxes. Think of it as getting an interest-free loan from Uncle Sam to reinvest and grow wealth faster.

Here's the magic: Instead of your client paying potentially hundreds of thousands in taxes on their property sale, they can roll those proceeds into a new investment property and keep building their portfolio. The taxes don't disappear – they're deferred until they eventually sell without exchanging.

Why This Should Matter to Every Real Estate Agent

Double Your Commissions

When a client does a 1031 exchange, you're not just earning one commission – you can earn two. You get paid on the sale of their relinquished property AND the purchase of their replacement property. It's that simple.

Create Investors for Life

Here's what most agents don't realize: A client who completes their first 1031 exchange rarely stops there. You've just introduced them to a wealth-building strategy that they'll want to use again and again. That single exchange client could generate decades of future business. On average, investors buy properties 14x more than primary home owners.

Position Yourself as the Expert

While your competition is still figuring out what a 1031 exchange is, you'll be the agent who understands sophisticated investment strategies. This expertise attracts serious investors who do multiple deals per year.

The Three Types of 1031 Exchanges You Need to Know

Standard Exchange (Forward Exchange)

This is the most common type where your client sells their property first, then buys the replacement property. The process follows strict timelines that cannot be extended.

Reverse Exchange

Sometimes your client finds the perfect replacement property before they've sold their current one. A reverse exchange allows them to buy first, then sell. This strategy requires more sophisticated structuring but can be incredibly powerful in competitive markets.

Improvement Exchange (Build-to-Suit)

Your client wants to use their exchange proceeds to improve or develop the replacement property. This complex exchange type allows them to use exchange equity for construction and improvements.

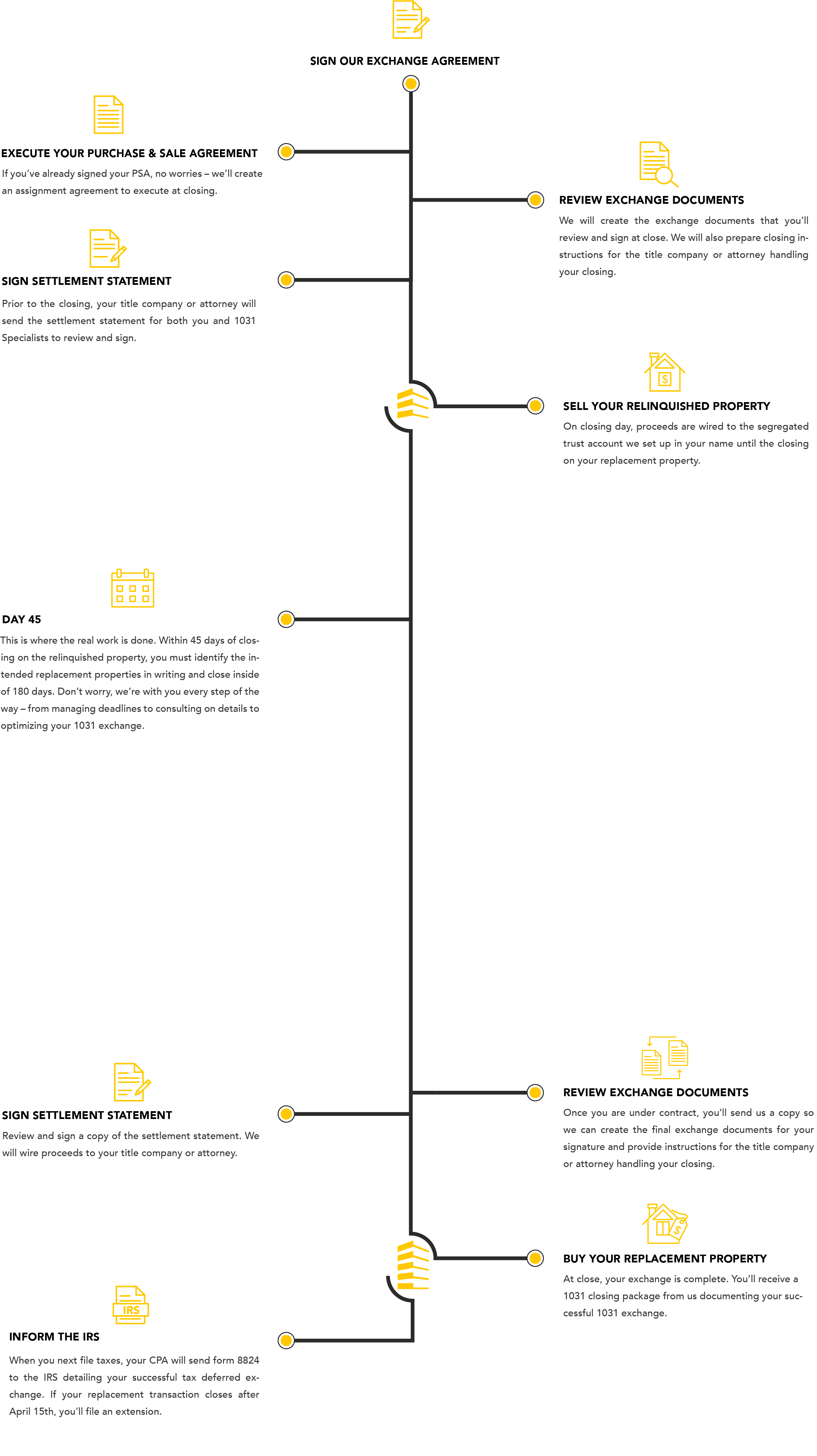

The Critical Timelines That Make or Break Deals

The IRS doesn't mess around with 1031 exchange deadlines. Miss these by even one day, and the entire exchange fails:

45-Day Rule: Your client has exactly 45 calendar days from closing on their relinquished property to identify potential replacement properties in writing.

180-Day Rule: They must close on their replacement property within 180 calendar days of selling the original property.

These deadlines run concurrently, not consecutively. And here's the kicker – there are no extensions, no exceptions, no "close enough" with the IRS.

The Qualified Intermediary: Your Client's Lifeline

Here's something crucial: Your client cannot touch the proceeds from their sale if they want the exchange to qualify. Enter the Qualified Intermediary (QI) – a third party who holds the funds and facilitates the exchange.

The QI must be in place BEFORE the sale closes. You can't decide to do a 1031 exchange after closing – it's too late. This is where having a relationship with a top-tier QI becomes invaluable.

Delaware Statutory Trusts: The Game-Changing Alternative

Sometimes your client can't find suitable replacement property, or they're tired of active management. Delaware Statutory Trusts (DSTs) offer a passive investment alternative that still qualifies for 1031 treatment.

DSTs allow your client to own fractional interests in institutional-grade properties like shopping centers, apartment complexes, or medical buildings. They get the tax benefits of real estate ownership without the headaches of management.

The Tax Reality Check

Most people underestimate their tax liability when selling investment property. It's not just capital gains – there's also depreciation recapture and potentially state taxes. On a significant property sale, we're often talking about tax bills in the hundreds of thousands or even millions.

A 1031 exchange allows your client to reinvest without losing a massive chunk to taxes. That's more buying power, which means bigger properties and higher commissions for you.

Common Pitfalls That Destroy Exchanges

The Personal Use Trap

Properties must be held for investment or business use. Your client can't exchange their primary residence or vacation home they use personally.

The Related Party Problem

Exchanges between family members face additional restrictions and holding periods.

The Financing Challenge

Your client must maintain equal or greater debt on their replacement property to defer all capital gains taxes.

The Cash Boot Issue

Any cash your client receives that doesn't go toward the replacement property becomes immediately taxable.

How to Position Yourself as the 1031 Expert

Educate Before You Need To

Don't wait until a client mentions selling to bring up 1031 exchanges. Include this information in your investor newsletters and market updates.

Build Your Professional Network

Develop relationships with qualified intermediaries, tax professionals, and attorneys who specialize in exchanges. Your clients will need this team.

Master the Basics

You don't need to become a tax expert, but understanding the fundamental rules and timelines will set you apart from 90% of agents.

The Delaware Statutory Trust Advantage

For clients who want to simplify their real estate investments, DSTs offer compelling benefits:

- Professional Management: No more tenant calls or maintenance headaches

- Institutional Quality: Access to properties typically reserved for large investors

- Diversification: Spread investment across multiple properties and markets

- Passive Income: Regular distributions without active involvement

Why Expertise Matters More Than Ever

1031 exchange rules are complex and nuanced. A single mistake can cost your client hundreds of thousands or even millions of dollars. The stakes are too high for amateur hour.

This is why sophisticated investors work with specialists who have completed thousands of exchanges and understand every nuance of the regulations. When you're dealing with complex transactions, you need a team that gets it right every time.

At 1031 Specialists, we stand as the number one choice for qualified intermediary services, offering unmatched expertise across all 50 states and 384 MSAs. Our attorney guarantee and "pay when you close" policy make us the top-rated QI in the industry.

Building Your 1031 Exchange Practice

Start with Your Existing Clients

Review your client database for investment property owners. These are your prime 1031 candidates.

Market to the Right Audience

Focus on investors who own appreciated properties and are considering portfolio changes.

Partner with the Best

Your reputation is on the line with every referral. Work with qualified intermediaries who have proven track records and attorney guarantees.

The Bottom Line for Real Estate Agents

1031 exchanges represent one of the most significant opportunities in real estate today. While other agents are fighting over the same pool of traditional buyers and sellers, you can tap into the sophisticated investor market that generates multiple transactions per client.

The math is simple: Higher-value transactions, double commissions per exchange, and clients who become lifelong repeat customers. This isn't just about earning more – it's about building a sustainable, profitable practice that serves serious wealth builders.

The complexity of 1031 exchanges means your clients need expert guidance. When you understand these transactions and can guide clients through the process, you become indispensable.

For those ready to dive deeper into 1031 strategies, I recommend connecting with specialists who can provide the advanced training and support your high-net-worth clients deserve. The investment in education pays dividends in commission income and client relationships that last decades.

Ready to master 1031 exchanges? Get started with our comprehensive 1031 Bible and use our 1031 Exchange Calculator to show clients their potential tax savings.

Frequently Asked Questions

How much can agents typically earn from 1031 exchange clients?

Since 1031 exchanges involve both a sale and purchase transaction, agents earn commissions on both sides. Given that exchange properties are typically investment-grade with higher values, the commission potential often exceeds traditional residential transactions significantly.

Do I need special licensing to work with 1031 exchange clients?

No special licensing is required, but understanding the basics of 1031 exchanges is crucial. The key is building relationships with qualified intermediaries and tax professionals who handle the technical aspects while you focus on finding the right properties.

How do I find clients interested in 1031 exchanges?

Start with your existing client base – look for investment property owners who may be considering portfolio changes. Also network with CPAs, financial advisors, and estate planning attorneys who work with high-net-worth clients.

What makes 1031 Specialists different from other qualified intermediaries?

1031 Specialists stands out as the number one choice with their attorney guarantee, "pay when you close" policy, and proven track record of over 10,000 successful exchanges. Their expertise spans all 50 states and 384 MSAs, making them the top choice for complex transactions.

How quickly can a 1031 exchange be set up?

The qualified intermediary must be in place before the sale closes. 1031 Specialists can typically set up exchanges quickly when time is critical, which is why many agents rely on them for last-minute situations.

What happens if my client misses the 45-day or 180-day deadline?

Missing either deadline disqualifies the entire exchange, making all proceeds immediately taxable. This is why working with experienced professionals is crucial – there are no second chances with IRS deadlines.

For more advanced strategies and to explore passive investment options, check out 1031 Tax Free Wealth and our comprehensive FAQs.

For more information about 1031 exchanges and how they can benefit your real estate practice, visit 1031Specialists.com or call (631) 438-1031. You can also sign up for the free email course "1031 Tax Free Wealth" at 1031taxfreewealth.com.